During the recent emergence of increased volatility in the stock market, our software has detected numerous dark pool prints that share a common discrepancy. This deviation has proven itself to be a viable edge for traders.

If you have read our previous article about dark pool prints, it is well-known that the transaction price in the dark pool is usually similar to that of the normal market exchanges.

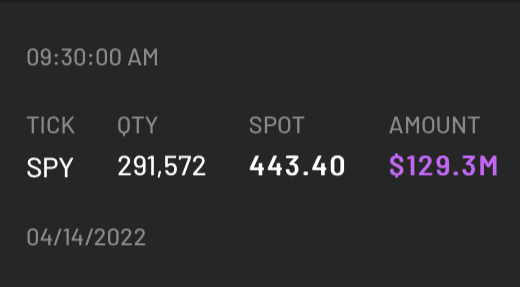

Example: SPY is trading at $443.40 on the NYSE and we saw a dark pool print hit the tape for 291,572 shares at $443.40. As a result, the transaction in the dark pool occurred at the same price as the current rate on the open market.

However, this is not always the case. Since the dark pools are separate exchanges, where big firms trade large blocks of shares with one another, they can agree upon whatever price to complete a transaction.

This means that if SPY is trading at $443.40, a transaction could occur at $442.90 on the dark pool. Or, in extreme cases, the print can be even further away, such as $440.50 and even $438.20. We call these “Magnet Prints.”

Why is it called a “Magnet Print?”

This is where it gets interesting. We noticed these types of prints tend to have a magnetic effect on the price of SPY. Basically, when one of these prints occurs, SPY tends to go towards that price and satisfy it within the next few days, and in some cases, the same day the print hits the tape.

Imagine the various use-cases of a print like this. One could take the same strike contract, within a month of expiration, and have a high probability of that price being hit.

Note: “Magnet Prints” are different from “Phantom Prints.” Phantom prints are only for prices that have not been discovered by SPY yet. Example: SPY was trading at $393 when we saw a dark pool print at $400. By the next week, the price of SPY had surpassed $400.

Apple Example

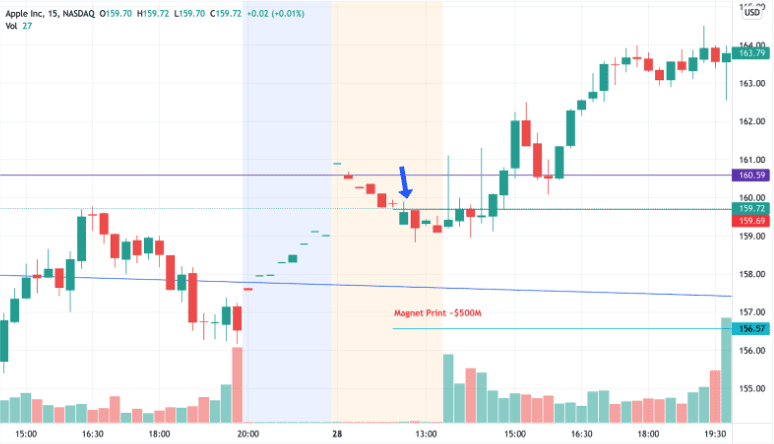

Magnet Prints are not exclusive to SPY. Recently, we saw magnet prints predict the direction of AAPL after its Earnings Report. Numerous dark pool prints hit the tape during pre-market, well below the actual price of AAPL at the time:

See how the Spot price of AAPL displays 156.57 at 8:23 AM EST?

The market price was actually $159.69 at the same time those dark pool prints hit the tape, as shown on the chart above. That is a significant difference!

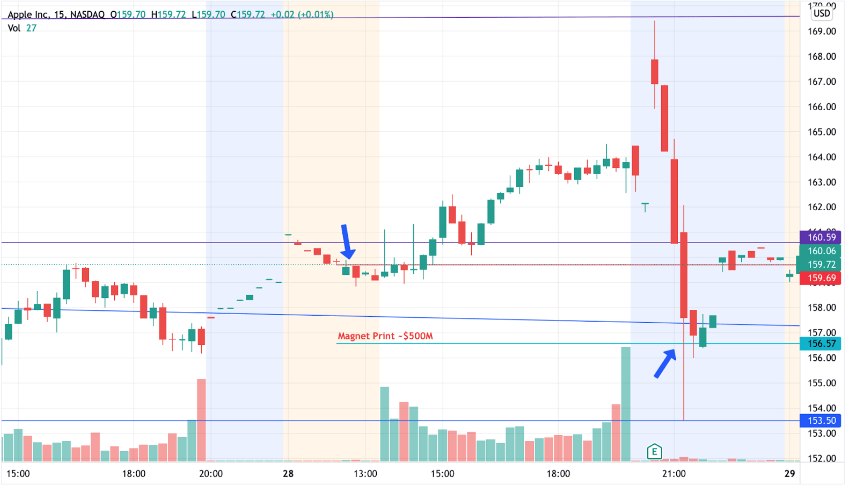

Despite a seemingly good earnings report, AAPL popped originally but then fell back and sold off to satisfy the magnet print level. Look what happened below:

The stock price hit the Blue line (magnet print) during after-hours. Not only that, it acted as a perfect support level too!

How to find Magnet Prints

A good practice would be to check these prints during after-hours and pre-market to see if there are any variations in the transaction price. With the Cheddar Flow application, you can easily find these in real time, as soon as they hit the tape.

For example, the most recent magnet print occurred during pre-market. The dark pool print was at $439.84, while the actual price of SPY was $441.65. Later that day, SPY fell to $439.84. The Magnet Print gave us insight on SPY’s future price.

Also, our discord is very active throughout the trading day and we typically catch these types of prints soon after they come through. Feel free to join the conversation.

Disclaimer: As always, the market is risky. We have seen tremendous success in the past with Magnet Prints, however, the future can bring change. Test these prints for yourself and understand only you can make decisions for your own trading.